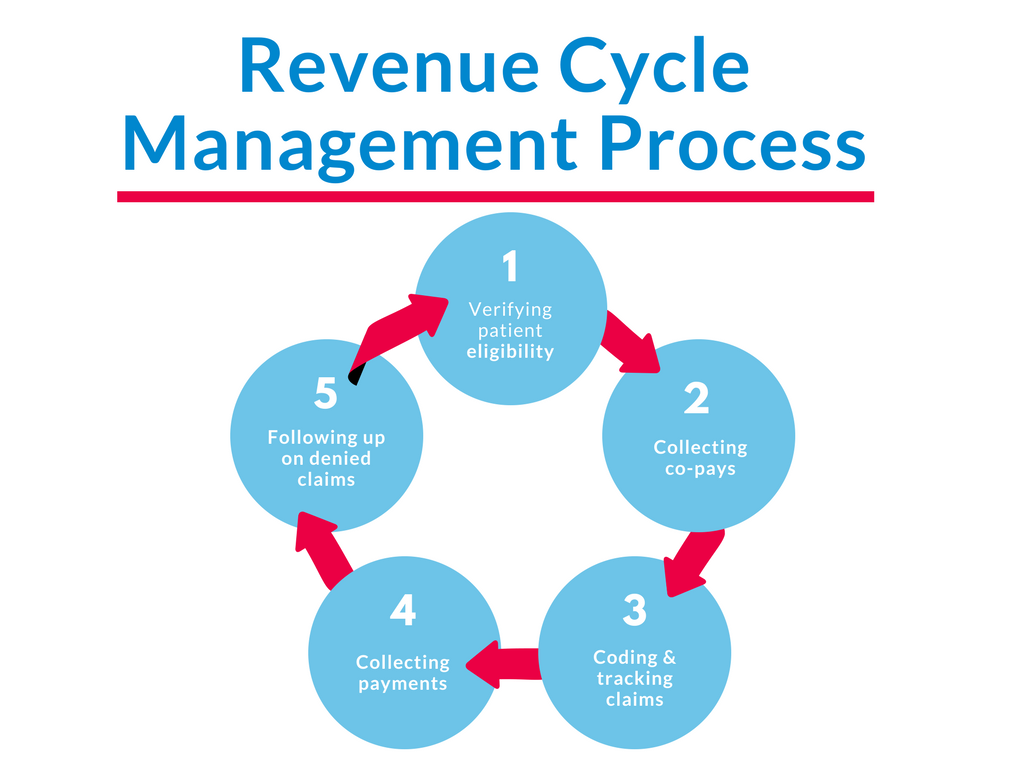

In virtually any organization, managing revenue is essential for sustainable development and economic stability. The revenue cycle encompasses the entire process from the first customer connection to the final assortment of payment. It involves numerous phases and activities that eventually determine the financial wellness of the organization. In this information, we will examine the revenue period in detail, discussing their important parts, problems, and strategies for optimizing financial performance.

Introduction to the Revenue Routine:

The revenue pattern represents the journey of revenue technology inside an organization. It typically begins with lead technology and advertising initiatives and progresses through income, purchase processing, invoicing, payment series, and reconciliation. Each period in the revenue pattern represents a crucial position in ensuring appropriate and reasonable revenue recognition.

Key Aspects of the Revenue Routine:

a. Lead Generation and Advertising: Getting potential clients and making recognition about products or services.

b. Sales and Customer Order: Converting leads into customers Provider Credentialing efficient income techniques and negotiations.

c. Buy Processing and Happiness: Receiving and handling customer orders, ensuring exact item distribution or company fulfillment.

d. Invoicing and Billing: Generating invoices for products and services or solutions made, including correct pricing and terms.

e. Reports Receivable Administration: Checking and gathering excellent obligations from clients, handling credit phrases and payment terms.

f. Revenue Acceptance and Reporting: Knowing revenue on sales rules and regulations, ensuring correct financial reporting.

Difficulties in the Revenue Period:

Controlling the revenue routine effectively isn’t without their challenges. Some common issues contain:

a. Erroneous Knowledge and Documentation: Imperfect or wrong data can cause delays in invoicing and cost collection.

b. Billing and Code Mistakes: Mistakes in billing or coding may result in cost rejections or delays, impacting cash flow.

c. Regular and Successful Conversation: Not enough obvious conversation between departments could cause setbacks or misconceptions in the revenue cycle.

d. Complicated Cost Systems: Dealing with varied payment methods, handling costs, and reconciling transactions could be time-consuming and error-prone.

e. Submission and Regulatory Requirements: Adhering to industry-specific rules and sales requirements can be complicated and involve constant monitoring.

Techniques for Optimizing the Revenue Cycle:

To increase financial success and ensure a smooth revenue pattern, organizations may apply the following strategies:

a. Improve Operations: Recognize bottlenecks and inefficiencies in the revenue cycle, and streamline processes to reduce setbacks and increase productivity.

b. Embrace Engineering: Implement powerful revenue routine administration pc software and automation resources to improve precision, rate, and efficiency.

c. Improve Data Precision: Invest in information validation and quality get a handle on steps to decrease mistakes and discrepancies in client data and billing details.

d. Improve Conversation and Cooperation: Foster powerful connection and venture between departments involved in the revenue routine to reduce misunderstandings and delays.

e. Check Essential Performance Indications (KPIs): Create and track applicable KPIs such as days income fantastic (DSO), series prices, and revenue growth to measure and increase economic performance.

f. Team Teaching and Education: Give continuing teaching and knowledge to workers mixed up in revenue routine to make sure a strong knowledge of processes, submission, and most readily useful practices.

Realization:

The revenue routine is a crucial facet of economic management and organizational success. By understanding the key components, issues, and implementing powerful methods, companies can improve their revenue cycle, improve income flow, increase customer satisfaction, and achieve long-term financial stability. Constant monitoring, version to market improvements, and a responsibility to method development are important for agencies to thrive in today’s competitive company landscape.